While The Bahamas is known the world over for its sunny beaches, beautiful weather and laid-back lifestyle, there are many other factors that make the island chain an attractive destination.

The Bahamas offers a wealth of opportunities for investors and business-minded individuals — from its established reputation as an international financial center to its thriving real estate market.

But what if your ambitions are a bit larger in scope and you want to operate a company in The Bahamas? Navigating legal requirements and restrictions to create a business can be challenging enough at home, let alone when dealing with a foreign government.

In this post, I’ll examine some of the ins and outs of Bahamas company registration, rules and requirements, how to set up a company in The Bahamas and some of the benefits of doing so.

The Benefits of Bahamas Company Formation

The Bahamas is a popular destination with investors, in part due to its overall wealth, stable economy, status as a tax haven and established offshore banking industry.

The government of The Bahamas welcomes foreign investors, although if you plan to operate a business in the country, you should be aware that authorities restrict the operation of certain types of business to Bahamian citizens only.

In this article, I will focus on Bahamas offshore company formation, which you are free to do without ever setting foot in the country. These are a lesser known alternative to BVI business companies.

There are numerous benefits to Bahamas company registration:

- No personal or corporate taxes

- Privacy for both corporations and shareholders, protected under The Bahamas’ International Business Companies Act of 1990

- Twenty years’ tax exemption for companies and shareholders after incorporation

- The Bahamas only requires corporations to have one shareholder and one director

- Minimal paperwork, as the country does not require annual returns or audited accounts

- Easy access to the Bahamian offshore banking system, which includes hundreds of banks from around the world

- Annual shareholder meetings may be held anywhere in the world

- The ability to conduct business anywhere in the world

If you establish a Bahamas limited liability company, you can take advantage of these additional benefits as well:

- Legal protection of assets against actions from outside the country

- No residential ownership requirements — the government permits Bahamas LLCs to be wholly foreign-owned

- Rapid registration process

- No minimum capital requirements

Obtaining a Bahamas Business License

All businesses formed within The Bahamas must register with the Business Licence Division. Once your application form and supporting documentation are submitted, the process takes approximately one week and costs BS$100 (equivalent to US$100).

Foreign citizens who plan to conduct business within The Bahamas must also get permission from the Bahamian Investment Authority. To secure this, you’ll need to submit a proposal, following the BIA Project Proposal Guidelines.

There are several recognized business structures you can consider when forming an offshore business in The Bahamas:

- Sole proprietorship — a business run by or as an individual

- Joint venture — only used for investment purposes in The Bahamas

- Partnership — a business run by multiple partners, sharing both profits and losses

- Limited liability company — run by directors, either private or limited by guarantee

- Unlimited liability company — a public company with at least three directors

- Foundation — generally used for estate and tax planning

Incorporating a Company in The Bahamas

There are different legal requirements and protections for incorporated companies in The Bahamas, based on whether they are foreign or domestic.

Domestic Companies

Companies formed under the Bahamian Companies Act of 1992 can be private or public. They must:

- File a Memorandum and Articles of Association at the Companies Registry

- Have a minimum of two shareholders and two directors

- Have a registered office in The Bahamas

- Hold annual general meetings

- File an annual statement including the names of registered shareholders

International Companies

Requirements for companies formed under the International Business Companies Act of 2000 are much less stringent:

- Must have one shareholder and one director

- Maintain a current filing of incumbent officers and directors (although they are not required to file annually)

- Must have a Central Bank designation of resident (only if conducting business within the country)

Incorporation Process

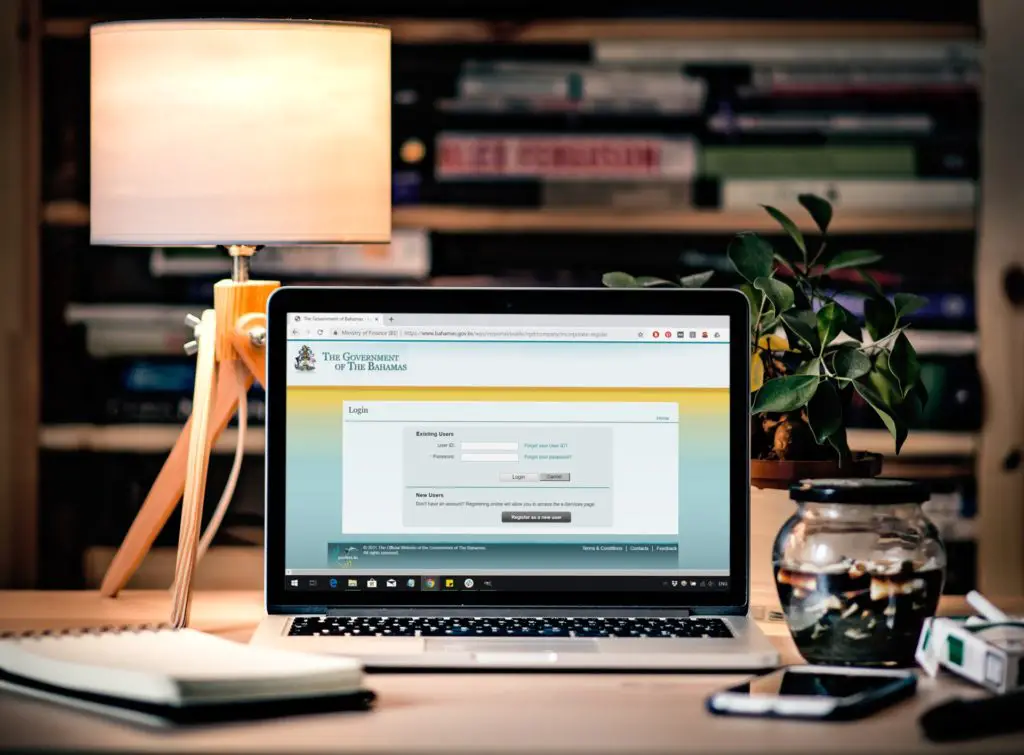

To incorporate your Bahamian business, all you need is a local attorney to sign the Statutory Declaration and Affidavit. Turnaround times for incorporation are very quick — often a matter of hours.

There is a simple, twelve-step process for incorporating a company in The Bahamas:

- Print your incorporation certificate and documents

- Register online at the government portal

- Log in to Registry Services

- Select “Reserve a Regular Company Name”

- Enter the details of your company

- Enter your company’s credit or debit information

- Print your receipt

- Select “Incorporate a Regular Company”

- Enter your Name Reservation number

- Complete the incorporation form

- Enter your credit or debit information

- Print your receipt after approval

Laws Governing Bahamas Company Registration

The Bahamian government make every effort to welcome foreign investment in the country and offer significant incentives to non-citizens bringing business or revenue to the local economy.

There are, however, still some legal requirements and obligations that you’ll need to consider when registering a company in The Bahamas.

Taxation

Citizens and non-citizens alike are under the same tax obligations — and receive the same tax benefits — in The Bahamas.

- There is no income tax, capital gains tax, or estate tax

- A value-added tax (sales tax) of 12% on some goods and services

- Property taxes for commercial properties are levied at 1% annually for the first $500,000 in value and 2% beyond $500,000

National Insurance

If your company has Bahamian employees, you will be required to contribute to the National Insurance system, which is not unlike the US Social Security System.

The law requires a weekly contribution of 5.9% of an employees wages — 2% from the employer and 3.9% deducted from the employee — to a maximum of $600 per week or $2,600 per month.

Repatriation of Profits

The Bahamian government does not place any restrictions on repatriation of profits. You are free to move any funds you make during the operation or sale of your business back to your home country without penalty.

Company Names

To gain approval for your Bahamas company registration, you must select a unique business name that does not closely resemble any other established Bahamian corporation. All corporations in the country must include one of the following at the end of their name:

- Incorporated

- Corporation

- Societe Anonyme

You may not form a business with any of the following words in the name unless you have previously secured official authorization:

- Bank

- Assurance

- Building Society

- Chartered

- Chamber of Commerce

- Cooperative

- Insurance

- Imperial

- Municipal

- Trust

- Royal

Business Activities

As I described in the section on incorporation, the Bahamian government distinguishes between international and domestic businesses.

Similar to equivalent entities in Belize, Bahamian authorities place fewer requirements on International Business Companies (locally referred to as IBCs). They are only restricted from certain activities. IBCs may not:

- Conduct business with Bahamian residents

- Own real estate in The Bahamas

- Engage in banking, insurance or re-insurance business

International companies are, however, permitted to own shares in Bahamian companies, open local bank accounts and engage the services of local professionals.

The Bahamas as a Tax Haven

The Bahamas’ reputation as a tax haven makes it a popular choice for offshore business registration.

While both individuals and organizations taking advantage of the country’s offshore financial services still enjoy minimal taxation and high levels of privacy, it’s important to note that the Bahamian government has recently passed legislation that prompted the EU to remove the country from their tax haven blacklist.

The Multinational Entities Financial Reporting Act

Under this legislation, some companies incorporated in The Bahamas with revenues upwards of $850 million must annually file a country-by-country report with the Minister of Finance.

This rule is aimed at ensuring The Bahamas’ compliance with Base Erosion and Profit Shifting standards set by the Organization for Economic Co-operation and Development.

The Commercial Entities Act

This law ensures that businesses that claim Bahamian residency for tax purposes actually have an economic and physical presence in the country. Under this legislation, the Ministry of Finance can levy reporting requirements against certain types of businesses.

The Removal of Preferential Exemptions Act

This act aims to eliminate “ring-fencing” — a practice in which preferential tax benefits or rates are given to certain groups or organizations that are not available to domestic residents. This is unlikely to have a significant impact on your business since Bahamian residents also pay no income or capital gains tax.

The Beneficial Ownership Act

This legislation creates a searchable private search registry of domestic and international businesses’ beneficial owners.

The registry, however, may only be searched by the Office of the Attorney-General, Financial Intelligence Unit, Central Bank of The Bahamas, Compliance Commission, Securities Commission and Insurance Commission, and these agencies must first establish that their search is lawful.

Want to Know More?

Bahamas company registration can be an appealing and easy-to-achieve goal if you properly understand your risks, rights and requirements.

If you still have questions about laws governing Bahamian businesses, how to incorporate a business in The Bahamas or the benefits of doing so, I’m here to help.

Don’t hesitate to reach out to me with your questions or thoughts.